The Master's Course

Unlock the power of Infinite Banking in every area of your life!

Proven strategies that will help you get the most out of your policies

A Message from Ray Poteet

Do you remember the good ‘ol days in the 1980’s and 1990’s when it seemed like all you had to do to be financially successful was to pour money into your 401k, never touch the money for 20 years, and then retire comfortably?

I definitely remember those days… I was working in the financial industry doing just that for 30 years! Well, I hope I’m not the first to tell you that the strategies that worked back then are what is causing the problems with many family economies today.

In today’s world, you need to gain understanding in order to succeed. Those who understand how to make money outside the box will be the most successful.

I’ve had an amazing experience over the past 14 years personally using the Private Financing system. For almost 30 years prior to learning about this system, I did everything conventionally (and told all my clients to do so). Though I was doing everything I was told by the “financial gurus” to do, I felt like a hamster on a wheel.

I had absolutely no freedom or control, but I sure did have lots of FEAR and STRESS.

I can tell you now, after 14 years of devoting my life to stretching Infinite Banking to the max, I no longer have any fear or stress when it comes to money. My Net Worth has increased by over 600% (and I haven’t even had to work any harder to do so).

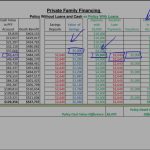

I now own a private financing company that has over $3,000,000 loaned to third parties, including SIX mortgages and NINE cars just in my family. This creates a MONTHLY cash flow of over $50,000 (and this doesn’t include the growth of the policies on top of that).

All of those loans are financed by my system of over 80 policies. The passive, TAX-FREE income from my Private Family Financing system is now greater than my lifestyle, so it truly doesn’t cost me anything to live!

We are desperate to bring YOU the same freedom that our family experiences today, and we find that the most efficient way to do this is through an online training course!

If you can watch a video, you can learn how to create a system that can benefit you and your family for generations to come…

The Three Pillars of Lifestyle Banking

Below is a short summary of each full feature length video that is offered in this course. Enrollment is free, so what are you waiting for?

Foundation

The Truth About Retirement Planning and Why Everything We’ve Been Taught is Setting Us Up for Failure…

Current Retirement Planning is based on one of Wall Street’s greatest deceptions. They have convinced us to focus on creating a large “Nest Egg”, and magically we will retire without much worry. Retirement has more to do with INCOME than asset value. Sadly, the tools conventional retirement planners use are focused more on asset value than income which creates unnecessary fears and potentially devastating results for those nearing or entering retirement. Learn the truth about why Private Family Financing may be the best solution to creating income in retirement.

Why Is Participating Whole Life Insurance the Perfect Vehicle to Use in Your Private Family Financing System?

Of all the tools and products available in the financial world, why is Participating Whole Life the most efficient tool to use in Private Family Financing? Learn once and for all why Whole Life is the perfect match to establishing your “banking” system!

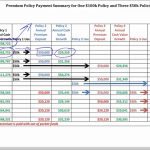

Policy Mechanics Part 1: Premiums- What is in My Policy and How Does it Work?

This lesson is for those who are interested in the intricate details of what makes the policy motor run. Learn exactly why we design your policies the way that we do, how we “stuff” your policies with cash compared to the traditional way of designing a policy, and even how to make your policies more efficient!

Policy Mechanics Part 2: Policy Loans- Why Paying Interest to the Insurance Company is a Good Thing!

One of the biggest misunderstandings in Private Family Financing is the interest we pay back on our policy loans. In this lesson, you will learn why the insurance company charges interest and how we can make more inside the policy than we pay in interest on our loan over time!

How Do I Pay Myself Extra Interest and What Does it Do to Improve My Policies?

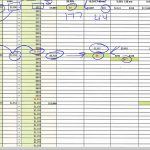

If you’ve been around us for any period of time, you’ll know we suggest that you pay yourself a higher rate of interest than what the Insurance Company requires for your policy loans. But it just doesn’t happen automatically. In this lesson, you will learn the most efficient way to send in additional interest to improve your PFF system, as well as how to utilize your “segregated account” to make the whole process run very smoothly.

Why Using Your Policy is Better than Paying Cash?

One of the most common questions we get is, “why should I use my policy to purchase _____ when I’m sitting on the cash?” In this lesson, we discuss why utilizing your policy makes more sense than simply paying cash for items. Come learn how to maximize the efficiency of every purchase you’ll make from now until the day you graduate by running it through your system!

How to Take Advantage of Your Financial GPS

Trying to navigate the Lifestyle of Infinite Banking without fully grasping how to use your personal Financial GPS is setting yourself up for failure! The Financial GPS is your guide to making your system easy to understand and follow. Understanding the GPS spreadsheet is vitally important to being confident in how to move forward. See why we want to hear from you anytime something changes in your life!

The Truth about Home Equity and How to Take Advantage of Long-Term Mortgages

Is it really a good idea to focus on paying off your mortgage as fast as possible? In fact, if you have a 15-year mortgage or are making extra principal payments on your house, you may be falling prey to what the Bankers want you to do! In this lesson you will learn why Warren Buffet thinks long-term mortgages are the average person’s best way to make a play on the American dollar, and how you can use your policies to increase your security, control, and profitability by “separating” the equity from your house and storing it in your policies!

Why You Might Want to “Incorporate” Your Private Family Financing System

There are many great reasons to start a corporation to handle your “banking” system, but it is not for everyone. Special Guest and CPA, Anthony Faso, discusses the “Who, What, Why, When, and Why Not” of creating a company to manage your Private Family Financing system.

Which Corporate Entity Will Give You the Maximum Tax Benefits in Your Situation?

Special Guest and CPA, Anthony Faso, joins us again to discuss the different corporate entities and the benefits of each. This will not only help you understand which corporation to choose specifically for Private Family Financing, but will also help you understand the benefits and shortcomings of each entity for any business endeavor you enter. Learn how to best take advantage of the Internal Revenue Code to maximize your profits!

Lifestyle

How to Start Lending Money to Your Business and Reduce Your Taxes

Learn why it’s important to use your policies to lend money to your business for things you are accustomed to financing, leasing, or even paying cash for. Not only will you be recapturing money that used to be leaving your hands, but you will also be able to reduce your taxes by creating an interest expense! However, there is a correct way and an incorrect way to turn these loans into legitimate business loans. In this lesson, you will learn how the money needs to flow, what interest rates need to be charged, and what documentation is needed to make these loans legitimate.

How to Use Your System to Get into the Lending Business and Truly Become Your Own Banker

https://vimeo.com/129155207 Ray Poteet discusses how he’s built a lending empire fueled through his IBC policies. Whether it’s loaning money to your business, your family members, or third parties, come and learn the most efficient ways to manage your loans.

How to use Home Equity (OPM) to supercharge your System!

This is one of the most powerful lessons in Lifestyle Banking. In the Foundation lesson on Home Equity, we learned why stuffing dollars into the equity of your house may not be the wisest decision out there. In this lesson, you will learn how to totally flip the scales on the banks by using THEIR money to make money in your own “banking” system. Conventional banks don’t use their own money to make loans, they use OUR money. For us to truly be our own bankers, we must learn how to use Other People’s Money to make money like the conventional banks do!

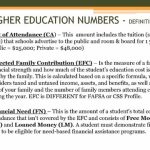

How to get the Most Financial Aid for your Child’s College Education

With the cost of college education spiraling out of control, it is vital to the financial well-being of your family to get the highest possible amount of scholarships and grants as possible! In this lesson, special guest Dr. Kris P. will detail exactly how he was able to save hundreds of thousands of dollars on college for his children simply by positioning his assets to ethically shield them from financial aid applications. This lesson is jam-packed with practical advice and is worth the entire course if you are someone with a child or grandchild who will attend university at some point in their lives.

The Smartest Way to Finance Your Child’s College Education

There are not many things more stressful than figuring out how to afford sending your children to college. With Infinite Banking, you can take the stress away by learning how to finance the education and get the money back! Come and learn how we’ve helped hundreds of families make it through college without destroying their financial future!

“What If I Could Get a Higher Rate of Return Elsewhere?” – How to Use Your Policies to Finance Your Investments

When most people hear about Infinite Banking, their first thoughts or question are bent on the “rate of return” inside the Permanent Life Insurance policy. However, Infinite Banking is not designed to have your money sitting in the policy! In this lesson, we will discuss how using your policy to finance other investments can potentially increase your after-tax profits from the investment!

Why You Need to Create a Line Of Credit to Your Business

Many businesses acquire a Line of Credit from a bank or lending institution in case of emergencies or to take advantage of opportunities. Now that you have your own “banking” system, why not set up a line of credit yourself? In this lesson you will learn how to properly set up a Line of Credit to your business and the benefits of doing so to keep more money in your pocket.

How to Use a Policy to Pay Your Taxes

For most people, taxes can be incredibly stressful and draining. But it doesn’t have to be that way! In this lesson, we will show you how to start financing your taxes in your system and make money while doing it! Note: Many times it is beneficial to open up a policy solely for the purpose of paying your taxes.

Why Your Retirement Programs Might Not Be What You Are Looking For, and How to Move Them Into Your IBC System

If you are looking to increase your safety, liquidity, and control, you will need a strategy of the best ways to move away from riskier retirement programs and into your own “banking” system. In this lesson, we discuss how to move your retirement programs into a policy and how you can immediately start using your policies created from your Retirement Programs to make even more money by keeping it in motion!

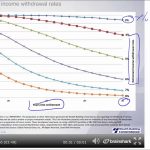

How to Draw Passive Income From Your Policies to Retire Stress Free!

As discussed in the Foundation lesson on retirement, retiring is all about Income! Unfortunately, very few people know the power that properly designed Whole Life Insurance has in creating passive income during your golden years. In this lesson, we will illustrate how to take income from your policies without taking any risk or paying any taxes on the distributions!

Legacy

How to Create a System of Policies That is Bigger Than You Ever Thought Possible (Laddering Policies)

How many banks have you seen that have just one branch? Many have branches all across town! The same goes for your system- the more policies you can capitalize, the more profitable your system will be. Without understanding this lesson, it will be difficult for you to turn Infinite Banking into a Lifestyle. Before we understood how to maximize the use of our policies, it would take the average person 16-20 years to have their PFF System of policies fully capitalized. We can now do it in a mere 7 years without even having to change your cash flow by using a system we call “laddering”. Learn how to leverage one policy to capitalize new policies and create a bigger Private Family Financing system for you AND the generations to come! This is one of the most powerful lessons in the Master’s course!

How to Incorporate Laddering Into Your Business (Laddering Part 2)

Policy laddering can help you build a bigger banking system than you ever thought possible, and is truly an ingenious way of building your family bank. But there’s a lot more to it than meets the eye, and it can even become better than you imagined when you first heard about it! Especially if you are a business owner… This lesson is tailored to how to incorporate laddering into your business, but even if you don’t own a business, the same principles can be applied to someone personally!

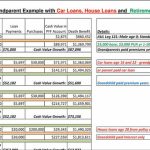

The Power of Keeping the Money in the Family

https://vimeo.com/130346963 In this lesson, we’ll discuss why your children should never have to see the inside of a bank for a loan. Learn to keep all the money in the family for cars, houses, and education by utilizing your Private Family Financing system to the fullest.

How to Bring the Family Back Together to Create Generational Wealth

How do the Rockefeller’s and the Rothschild’s keep their wealth from generation to generation? They emphasize STEWARDSHIP! Learn why teaching your children about Infinite Banking and having them use the family bank instead of third party institutions can create massive wealth for generations to come.

Why It’s OK To Not Pay Back Your Policy Loans During Your Lifetime

All the financial institutions in the world want your money TODAY while the dollar is good, and they want to pay you back with weaker dollars in the future. Let’s flip the scales. Instead of you using the weak dollars later in life, learn how we can use good dollars today and pay the insurance company back with weaker dollars in the future, maybe even at death!

Why Starting Policies on Your Children and Grandchildren is Vital

There is no better way to have your Private Family Financing system live on in your family even after your death than to capitalize policies on younger generations. But not only just to build the policies, but also to teach them the truth about how money works and the STEWARDSHIP needed to create lasting wealth.

How Grandparents can set up Their Grandchildren for a Lifetime of Wealth

Many grandparents have a desire to help their grandchildren in as many ways as possible, not only financially but also with wisdom and understanding. In this lesson, Ray actually goes over a policy that he started on his first great grandchild, and showed how it was possible that with a relatively small policy, his grandchildren and great grandchildren can be set for life by using the policy he started on them for cars, mortgages, and ultimately for a large stream of tax-free retirement income.

How to Increase the Amount You Can Donate to Charities by Financing Your Giving Through Your Policies (Part 1 and 2)

Becoming a cheerful giver of all that you’ve been blessed with is one of the greatest joys in life. Learning how to make money while giving to charities is the icing on the cake! Understanding how to use your policies in your normal charitable giving can drastically increase the amount available to give to charities without having to make more money or change your cash flow. In this 2 part series, learn how to change the method of your giving to create an abundance by utilizing your policies!

Your Membership includes Lifetime Access to these and all future lessons!

In the past, we have hosted advanced training sessions and have charged over $3,000 to attend the training.

Hundreds of people have gladly paid that price to learn the advanced strategies we are offering through Lifestyle Banking.

However, in an effort to make sure that EVERYONE has the opportunity to learn the true power of Private Family Financing, you can access this course at a special discounted rate.

LIFETIME ACCESS

We believe strongly that the strategies in this course have the power to make you a Private Family Financing Pro. If you are not fully satisfied for any reason, contact us within the first 90 days of your membership for a full refund of your purchase price.